The economic measures marked by return of protectionism, dismantling of social security network and the trade war with China to combat the stagnation in American domestic economy are more a sign of desperation for the Trump administration rather than rational economic steps to effectively revive the economy. Despite rhetoric and bravado, in reality, the American economy is still to recover from the crash of 2008. In fact, experts are pointing at “looming storms” of a major, and possibly worse, economic crisis within the next couple of years, that would rock the global economy yet again, little more than a decade after the sub-prime mortgage crisis. The alarm bells are ringing, loud and clear. Siddhartha Dasgupta writes.

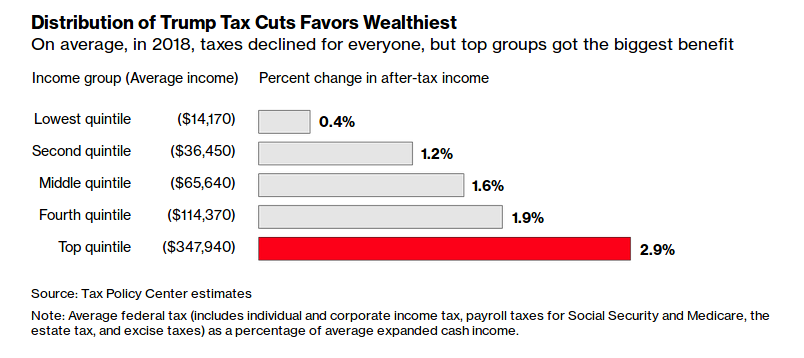

Concerns are growing again over the US economy. On the Wall Street, US stock markets plunged more than 650 points last Monday marking the worst December decline since The Great Depression of the 1930s. According to media reports, American Treasury Secretary conducted an emergency secret meeting with the top financial regulators, after holding a call with six of the largest American banks, including the likes of JP Morgan Chase, Bank of America, Goldman Sachs, etc., allegedly in a bid to “shore up the economy”. Earlier this year the Donald Trump administration passed the biggest ever tax cuts for the richest Americans, while repeatedly claiming that the tax break would be good for the American economy. According to some estimates, this tax cut would cost the American public as much as $1.9 trillion over the next 10 years. Despite the promises however, the stock exchange has taken a historic plunge. President Trump has blamed the policies of the Federal Reserve, the top national bank and financial regulatory body of the country, for the current tremors in the stock market, blaming the institution for “not understanding how the market works”.

“The American economy never really escaped the crash of 2008. Last 10 years it has been an economy on life support with vast amounts of money pumped into the economy, record drops in interest rates,… a debt sustained situation, and after a while you can’t mount up the debt on the basis of an economy that hasn’t really gotten going,” said economist Richard Wolff in a recent interview while commenting on the latest plunge in the stock exchange. Wolff in his books has argued that historically across the world, capitalism has gone through a downturn every 4 to 7 years on an average, with several major ones, such as The Great Depression of the 1930s. The last big downturn of the American economy was in 2008 with the housing crisis, and many, including major stock market observers and many of the banks themselves, have been apprehending that a renewed crisis is due anytime now. “As we have put it, ‘fix the roof while the sun shines’. But, like many of you, I see storm clouds building and fear the work on crisis prevention is incomplete,” said David Lipton, the first deputy managing director of the IMF in a recent interview to The Guardian. “The Bubble’s Losing Air. Get Ready for a Crisis”, screamed the headline of another recent opinion piece on Bloomberg.

That capitalism's instability (downturns every 4-7 years on average) has never been overcome is only half the problem.

The other half is that the system always neglects to prepare for the next downturn.#HowCapitalismWorkshttps://t.co/xk77IJYBWv

— Richard D. Wolff (@profwolff) December 13, 2018

The initial warning signals have started coming in. Short term loans are now being charged higher interest than long term loans, in a reversal to the usual interest policy. Typically this is indicative of the fact that the market predicts a crash in the near future, and many have read the recent trends in these interest rates to predict a serious recession by 2019, or latest by 2020. Earlier this month, the London-based FTSE 100 index recorded its worst day since the Brexit vote, wiping off £56 billion of the richest companies. Across the Atlantic, bringing back memories of the build up to the 2008 crisis, two big American chains, Sears and KMart, filed for bankruptcy this October. While the executives who presided over the bankruptcy are taking home $25.3 million in bonuses, the workers at Sears have begun to get laid off. “Those top people and (Sears CEO Eddie) Lampert are having a wonderful Christmas. They got $25 million in bonuses. Me? I’m late on my bills. The electric company is threatening to shut me off. And I don’t have anything left to spend on the kids this Christmas,” said one of the laid off employees.

For the last 10 years, the American Federal Reserve had kept its interest rates almost close to zero, to encourage lending, and steady an economy in inherent crisis using the temporary booster dose of debts. The purported reason why this hasn’t yet caused inflationary pressure on the economy is that there was not enough incentive in the economy to invest this money into production, something that might have driven up the prices mainly since American people can no longer afford to buy things the way they used to a decade ago. The wages have reportedly stagnated, the debts have risen, and there is general fear among the people to borrow the way they once did. “They still do borrow, but not at the same scale as before. All that extra money has therefore gone to the stock market, which went on with buying shares making quick money with the hope that the share prices would go up. That is how the rich people make their economic decisions. You see the stock market go up, but with the underlying real economy not really going anywhere. After a while, that is no longer a sustainable arrangement,” added Wolff. After almost a decade of low interest rates across the world, the total value of global debt, both public and private, has risen by 60% to hit a record high of $182 tn. According to a Bloomberg investigation earlier this year, “Now the easy money is coming to an end. Policy makers, after driving interest rates to unprecedented lows, are hiking those rates for the first time in 10 years. For many companies, it will bring new financial pressures. And for some of them, those pressures could trigger disaster … The search identified 69 companies spanning the globe that have boosted their debt levels by 50 percent or more in the past five years and now have at least $5 billion of debt. Together, they’re sitting on almost $1.2 trillion of bonds and loans, most of it rated junk and the majority due within the next seven years”.

Post the Trump tax cuts, the Wall Street companies bought back their own shares with the new money, seeking to drive up their prices, instead of using it to hire people, or raise wages

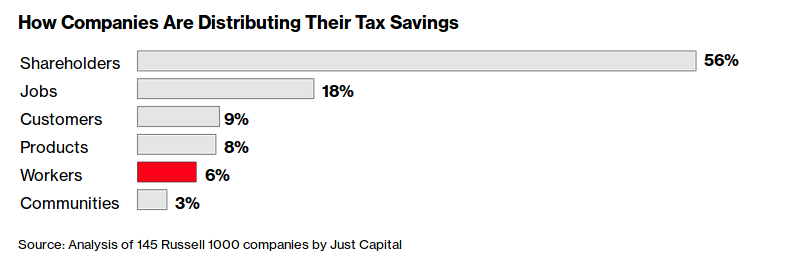

Many have claimed that the apparent “leaking” of the information to the media about the secret meeting of the Treasury Secretary with the big banks and the financial regulators was in fact not a leak, but a tactical let out into the public by the administration in an attempt to convince the American people that the Government is working to steady the ship. However, with the 2008 crash still fresh in the nation’s memory, there seems little confidence among the public. Post the Trump tax cuts, the Wall Street companies bought back their own shares with the new money, seeking to drive up their prices, instead of using it to hire people, or raise wages. “According to an analysis of 145 of those company announcements by nonprofit Just Capital, however, just 6 percent of tax cuts were allocated to workers. Most of that windfall went into one-time bonuses rather than a permanent wage hike,” reports Bloomberg. 56 percent of the tax cuts went back into the share market. “There’s no sign of a corporate spending spree. Non residential business investment rose 2.5 percent in the third quarter, the smallest increase since the final three months of 2016,” the same report goes on to add. Mainstream media however projected the rise in stock prices as indicator of the fact that the economy was doing good and strong.

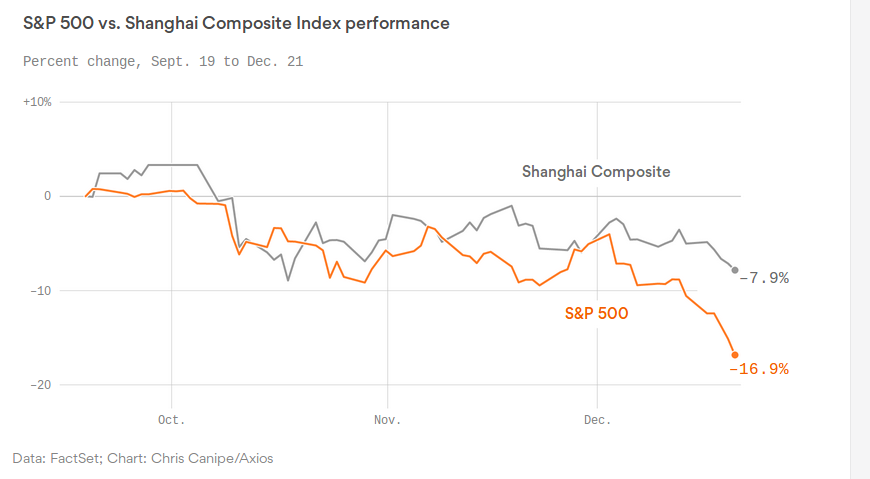

A second factor that is being claimed to have played a role in the currently unfolding situation is the ongoing “trade wars” between the US and China, where both countries have been putting retaliatory protective tariffs on their mutual imports. American politics has for many years now been dealing with domestic pressures stemming from the decades long policy of outsourcing jobs to China, India, Brazil, Bangladesh and other countries where labour is cheap. This has created problems of unemployment, underemployment, wage stagnation and economic lull in the country. The US trade deficit has been rising through the roof. On the other hand, new big economies like China, have at the same time raised their bids for a bigger share of the pie in global trade. During his election campaign, Donald Trump had promised to bring down the deficit through imposing tariffs on Chinese goods entering the US market. Trump’s trade wars with China, cutting dangerously close to a military conflagration particularly when it comes to control over the trade routes in the South China Sea, is a fallout of the political compulsion of preserving his vote base angry with the issues of jobs and wages, and the economic crisis of managing the trade deficit. But not only have the deficit not gone down after Trump’s “trade wars”, but in fact the US trade deficit is at a 10 year high currently. Moreover, these trade wars between two major economic powers in the world are a significant shift from the post-Cold War neo-liberal economic model, striking anxiety in large parts of the business world that is not used to such protectionist economic policies. Companies around the world have become uncertain about their investment plans, and about the yet-to-unfold trade policies in near future.

Last three intense months of the US-initiated trade/tariff war dropped US stock market twice as far as Chinese stock market fell

While it is true that the current decade has been the period with the lowest unemployment records in American history, many economists have observed that out of those who are employed, a vast section is severely underemployed. The quality of the jobs have vastly degraded over this decade. Most of the people who have jobs now, had better paid jobs earlier, with better benefits and social security. Many have pointed out that the jobs that have been created in recent times are heavily underpaid, with very low wages, shrinking pensions, and with the social security being virtually gone. A huge proportion of the American working population don’t know how to survive from one week to the next, how many hours they’d have to work, how much they are going to get paid. People have used up their savings since the massive crash of 2008, and have no choice but to offer themselves up for poorly paid jobs without any social benefits. Many have in fact attributed Donald Trump’s election victory to this accumulated popular anger about their economic helplessness, as people realized that the 8 years of “job-washing” by the Obama administration was a hoax. After the 2008 crash, CEOs of the big banks that caused the crash in the first place, walked away with even fatter pay cheques than they did before the crash. “Lets ask whether the best way to organise our [economic] enterprises is to have a tiny group of people – board of directors, major shareholders – make all the decisions where the rest of us have to live with the results but we have no input. A country [the US] that promises to have committed to democracy has never faced the fact that in the enterprise, we don’t have democracy,” said Richard Wolff in an interview to Democracy Now.

These trade wars between two major economic powers in the world are a significant shift from the post-Cold War neo-liberal economic model, striking anxiety in large parts of the business world that is not used to such protectionist economic policies

In the 1930s, while the US economy was reeling under The Great Depression, a powerful coalition of the Communists, Socialists and Unionists in the country had pressured the Roosevelt administration to introduce 4 major legislations – collectively called the ‘New Deal’ – in a way that no administration prior to that had done. This included the creation of the American Social Security System (that included old-age pensions, benefits for the injured and disabled, etc.), the Unemployment Compensation system (to support workers who lost their jobs because of their employers’ faulty economic decisions), the first Minimum Wage Act, and a guarantee that the Government would employ millions of people who wouldn’t be hired by the private employers. This Deal was funded by taxing the corporations and the rich. Roosevelt was re-elected a record 3 times across the 1930s, riding on a popularity wave largely based on the New Deal. The ‘New Deal’ kind of legislative measure that had taken place for the first time during the Roosevelt regime that helped the American economy come out of The Great Depression, never happened again in American history.

Today, in Donald Trump’s America, as social benefits and job security have been almost wiped out, and the economy seems to be on the verge of another historic plunge, with an unprecedented economic inequality plunging the economy into new levels of instability, people have renewed their demands for a new ‘New Deal’, one that some democratic and socialist politicians like Bernie Sanders and recently elected Latina woman Senator Alexandra Ocasia-Cortez have been calling the “Green New Deal”. This is because this New Deal also includes serious policy measures for protection of the environmental from capitalist destruction, amidst worldwide growing concerns of an irreversible climate change hurtling towards an environmental catastrophe. In the absence of desperate immediate legislative measures like the New Deal, the impending economic crisis seems guaranteed. The question is, how bad will it be, and how long will it last? Economists today are almost unanimous that if it is anything like what happened in 2008, the world is going to be in deep trouble, since a 2008-style bail out using public money cannot be repeated anymore because of the already enormous public debt and trade deficit. Moreover the Federal Reserve interest rates have already stayed close to zero for the past decade, and hence cannot be lowered any further. The alarm bells are ringing, loud and clear.

The author is a freelance journalist and political worker. Feature image courtesy Medium.com.