Prime Minister Narendra Modi, while inaugurating the 3rd annual meeting of the Asian Infrastructure Investment Bank in Mumbai on June 26, gave a rare speech on the state of Indian economy in recent times. In an earlier post we presented a brief scrutiny of the PM’s recent claims about the economy, based on what he said. But what is it that he didn’t say? While that list runs long, here we focus on three vital omissions: rising unemployment, decrease in real wages, and the horrible state of affairs in India’s largest domain of employment – agriculture.

Rising Unemployment

Believe it or not, in talking of the Indian economy Mr. Modi forgot to talk about the present unemployment situation in the country. The unemployment rate in India, rising sharply from the 3.4% in July 2017, reached around 7.25% during the first fortnight of April 2018 – high compared to the levels observed in a fairly long time. However, this is not just a phase, or a kink in the system, nor is it solely the making of Narendra Modi, though he has definitely aggravated an already dire situation. The Labour Bureau’s Employment-Unemployment Survey report showed recently that the proportion of Indian workforce (those actually working, as a percentage of the total employable population) in fact declined (when it is usually expected to only grow in any reasonably functional modern economy with a growing population) from about 54% of the working age population in 2011-12 to 51% in 2015-16. While the working age population increased by 2.9% per year during this period, the number of people with jobs increased at less than half that rate, at just 1.2% per year. The Labour Bureau’s data also reveals “the piling backlog of unemployed”. While the working age population increased by 4.66 crore between 2011-12 and 2015-16, those who were working increased by about 1.1 crore over the same period. That is, out of about 1.2 crore people who become ready to work every year, only 0.2 crore actually get jobs.

In a June 2018 article titled “India’s Labour-Market ‘Pivot’: Rough Estimates, Origins, and Implications”, Bernard D’Mello estimates the size of the Indian “reserve army of labour” – the pool of the unemployed and the underemployed, along with the petty commodity producers and service providers among the self-employed – the vast reinforcement of potential workers that is available to capital in this country. According to D’Mello’s estimates and calculations based on the National Sample Survey Organisation’s figures, the total size of India’s reserve army of labour in 2011–12 was 1.3 times that of the active army of labour. To the reserve army of labour, if we add on an average one dependent per employable person, then the total number swells to 484.8 million persons (40.1 percent of the country’s population).

Photo Credit: Lok Samiti

This presents capital with a huge pool of labour available for hire, while simultaneously forcing “discipline” and “efficiency” on those who are already employed. “The threat of unemployment and underemployment hangs like the sword of Damocles over the heads of all those who work for a wage under capitalism, and this is the real source of capitalist efficiency, the real means of increasing the rate of exploitation of the active army of labour,” writes D’Mello. One of the impacts of this can be seen in how the real wages* are driven down, or prevented from increasing, because of the availability of such a large number of people ready to work at any cost. This brings us to the other point that Mr. Modi forgot to mention: that of wages.

Decrease in Real Wages

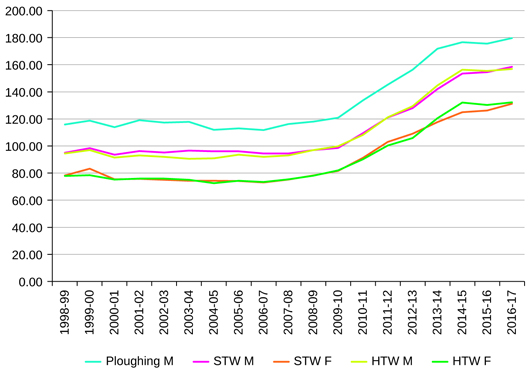

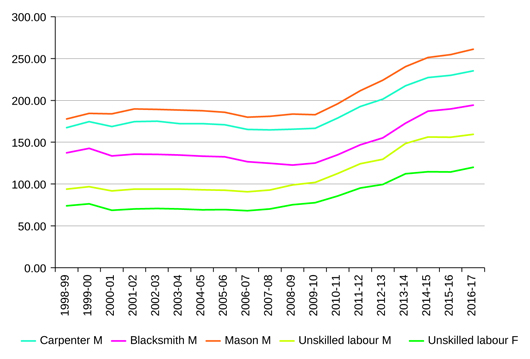

The graph below shows the rate of growth in real wages across some of the major professions in the country, from 2010 to 2017 [Note: STW = Sowing, Transplanting, and Weeding, HTW = Harvesting, Threshing, and Winnowing].

Source: Wage Rates in Rural India, 1998–99 to 2016–17, Arindam Das and Yoshifumi Usami, based on the Labour Bureau survey data

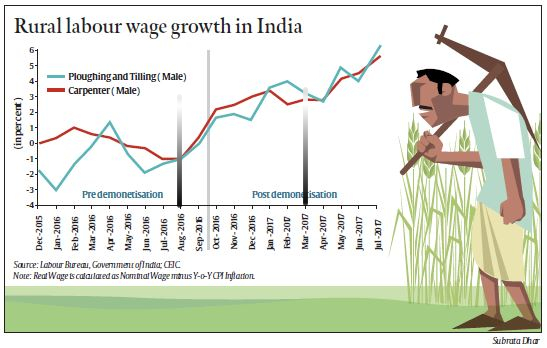

The sharp increase in the wages around November 2013 is largely because of a shift in the methodology of data collection by the Labour Bureau, so we need not spend much time over it here. What is however noteworthy is the steep, almost catastrophic fall in the growth rate of wages in every profession post 2014, including even negatives at times, meaning wages actually fell in real terms instead of growing (let us not forget that this is the same period when Mr. Mukesh Ambani increased his personal wealth from $18.6 billion in March 2014 to $45.4 billion as of July 2018) – something that Mr. Modi and Mr. Jaitley owe an answer for, to the entire country. Arguably, one of the main reasons for the fall, are back to back drought years – about which of course the Government did nothing in terms of relief measures for the economy and therefore the people. The marginal improvement around 2016, though still way below the 2013 rates, can similarly be attributed largely to a good monsoon year overall. However, certain people like Surjit Bhalla, recently appointed to the Prime Minister’s Economic Advisory Council, have attributed this marginal increase in the growth rate of wages to Demonetization! Mr. Bhalla, to his credit staying true to the numbers, used the following graph to prove his point:

*Vertical lines for Aug 2016 and Mar 2017 are GroundXero additions. Source: Indian Express

But, surely enough, he fails to explain why his own graph shows the rise beginning already in August 2016, while demonetisation was to happen only later in November. In his rebuttal of Mr. Bhalla’s gymnastics with data, economist Himanshu attributes the continual recovery of the growth rate of wages post demonetisation to (i) “most landlords preferring to dispose their cash by paying wages at higher rates than depositing the money in banks”, and (ii) increased spending by the government in rural areas post-demonetisation once it was clear that demonetisation had disrupted the rural economy – for example, the large increase in spending on the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) which continued until March 2017.

Point (ii) of the argument above deserves more attention.

Source: Wage Rates in Rural India, 1998–99 to 2016–17, Arindam Das and Yoshifumi Usami, based on the Labour Bureau survey data

Source: Wage Rates in Rural India, 1998–99 to 2016–17, Arindam Das and Yoshifumi Usami, based on the Labour Bureau survey data

The graphs above depict real wages from 1998-2017. While till 2006, wages remained largely stagnant and at times even declined in real terms, we see marginal rise beginning to happen in 2006, particularly in agriculture and allied professions. The reason for this is largely attributed to the introduction of the NREG Act in 2005. This takes us back to Himanshu’s argument, “While MGNREGA work is a small component of the rural labour market, there is now enough evidence to suggest that it does create upward pressure on wages by acting as a floor”. Though the wages continued to grow marginally post 2014, the fall in the rate of that growth is visible even in these graphs.

Source: Internet

State of Indian Agriculture

This brings us to yet another point the Prime Minister forgot to talk about: the state of Indian agriculture – still the biggest employer of Indian people. According to some estimates, more than 3 lakh farmers have committed suicide in this country in the past 20 years – many of them by drinking pesticides. According to Newsclick, “Rural areas, home to the country’s biggest workforce in agriculture, showed a small annual increase of only 1% in employment”. For 3 subsequent years, from 2014 to 2016, the Indian agricultural sector shrunk. While in the first two years it was due to consecutive droughts in both years, in the third year it was thanks to demonetization: “In 2014, agriculture GDP contracted and in 2015, it was almost flat. These factors severely dented agricultural incomes. Since wages were anyway going down, rural demand collapsed by 2015…. in a normal monsoon year in 2016 after two consecutive droughts, when the situation was improving, demonetisation broke the back of the informal economy. It acted almost like a drought does on the economy. And the non-agricultural sector that usually acts like a sponge, failed to do so.

Delhi: Tamil Nadu farmers stage nude protest outside North Block, demand drought relief fund#ITVideo https://t.co/NounxnP7mg pic.twitter.com/vC7SpvwlO1

— India Today (@IndiaToday) April 10, 2017

“Demonetisation delayed hopes for the revival of the economy, and demand deflation was extended,” remarks Himanshu, in an interview to Scroll.in. According to several economists, these repeated and consistent assaults on the economy – particularly on the informal sector and agriculture and allied sectors – has severely damaged the engines of the Indian economy, and this is beginning to have spill-over effects in other sectors such as industrial production, services and even exports. While capital investments by the Government has been keeping the economy going somehow, economists like Himanshu are skeptical of this as a long-term strategy. “Farm loan waivers by nine states have sucked up the resources of state governments – there is a decline in capital formation in the states. That is telling us that state government expenditure towards investment is going down. The spending capacity of states has been squeezed quite dramatically and total fiscal deficit (the difference between total revenue and total expenditure) of states has increased. This will have an impact on the government’s ability to ramp up expenditure in the coming months to revive demand. Remember, by the end of June, the Central government had already reached 92.4% of its fiscal space. So, there is not much maneuvering room left for either the state or the Center,” he remarked in the same interview given in September 2017.

Since then, the ONGC merger with another public-funded oil company HPCL, has bought the Government some fiscal breathing space, though there is dispute among economists as to whether this should count since it’s ultimately one public sector company buying another, without a net inflow of cash into the economy. But the Government is now planning re-capitalisation of IDBI by LIC along the same lines. In any case, while the Ruling party as well as the Opposition are all scrambling about farm loan waivers, mostly to contain the ongoing farmers’ agitations across the country and to woo electoral mileage, no one in the current economic setup has any answer to the deep structural crisis of Indian agriculture where “the income of 87% farmer families were lower than their expenses, … the average loan amount of a farmer’s family has increased from 49.6% in 2002-03 to 61% in 2012-13, … the total amount of loans of 9 crore farmer families was Rs. 4,23,000 crore, among which 1,23,000 crore (29.5%) was taken from money lenders, businessmen, landlords and shop-owners (loans that can’t be waived by a Government)”.

In protest, UP Farmers dump potatoes in from of CM Adityanath’s residence. Courtesy: NDTV

The list of major talking points about the economy that the PM forgot to ‘touch upon’ is long. Credit to large companies growing at only 1% year-to-year, Rupee being at a historic low at around Rs. 70 per US$, economic impacts of the GST particularly on the small industries and informal sector, or ‘Bad Loans’ or ‘Non-Performing Assets’ reaching a high of Rs. 10.3 lakh crores (a staggering 8.5% of the country’s GDP, 7.5 times the total 2018 budget allocation for education, health and social security combined, more than 3 times the all-time total farm loan waivers estimated to be around Rs. 3.1 lakh crore), Nirav Modi, Vijay Mallya, ‘black money’, Demonetization and the manifold increase of indebtedness of a large section of the population etc., – are only a few of the items in that list. Mr. Modi did not find it necessary to explain to people of this country, why in the face of such astronomical amounts of bad loans and in the middle of such wreckage of the country’s economy, he is forcing the State Bank of India to give an infrastructural loan to Mr. Adani for building infrastructure in Australia! According to economist Prabhat Patnaik, people have lost income in actual terms between 2013-14 and 2017-18. Moreover, this is the gross picture, and includes the Adanis and the Ambanis who actually became richer like never before in history. This means the landless, small farmers, agricultural labourers must have lost a huge amount of money. The PM had no words to spare for this either.

Critical and urgent challenges facing the nation have been left unaddressed. Beyond impacting the immediate short-term, this is corroding the long-term potential of the nation. People feel frustrated and have lost hope in the system. Things must change, and they must change now.

These are not our words. These are from Mr. Narendra Modi’s election manifesto in 2014. Could they be any more appropriate today?

[*Note: ‘Nominal wages’ are wages received by a worker in the form of money, for example, a worker gets Rs. 200 from her organization in exchange of her labour. On the other hand, real wages can be defined as the amount of goods and services that a worker purchases from her nominal wages. If we are to compare wages across different time periods, real wages should be the concern, not nominal wages. For instance, a wage of Rs. 100 in 1980 would be very different in value, in terms of the goods and services it can get, than a wage of Rs. 100 in 2018. In computing real wages, economists take into account such factors and adjust the numbers suitably so that we get figures that can be compared]